Understanding Job Costing in Construction —

Master construction job costing with our step-by-step guide. Learn to track expenses, analyze profitability, and make data-driven decisions.

Job costing is a critical process in the construction industry that involves tracking and analyzing the costs associated with a specific project. This method allows construction companies to estimate expenses accurately, monitor ongoing costs, and evaluate overall project profitability. By breaking down costs into various categories—such as labor, materials, equipment, and overhead—contractors can gain a comprehensive understanding of where their resources are being allocated.

The importance of job costing in construction cannot be overstated. It enables project managers to identify cost overruns early on, allowing for timely adjustments to stay within budget. Additionally, accurate job costing helps in setting competitive bids for future projects by providing historical data on similar jobs. This practice not only enhances financial accountability but also improves decision-making processes throughout the project’s lifecycle.

The Role Job Costing Plays

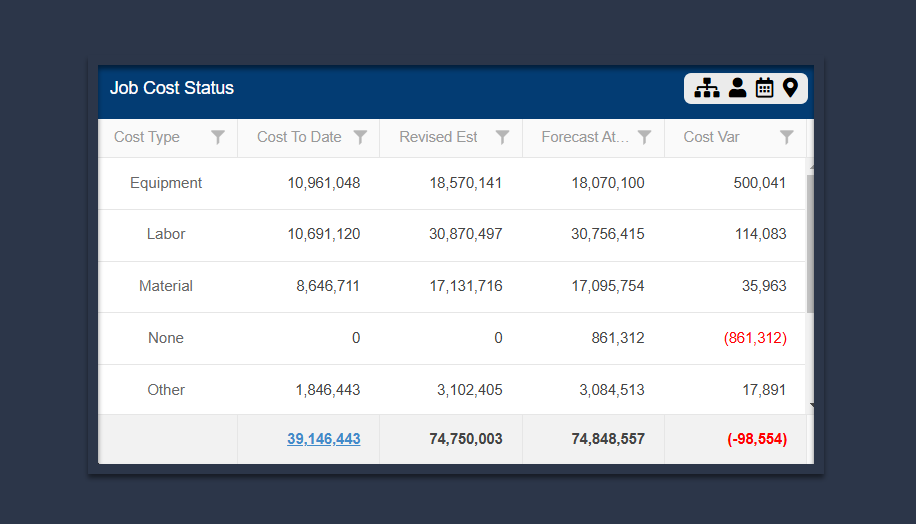

The job costing process provides detailed insights into the costs associated with specific projects, allowing managers to analyze expenses against budgets and expected outcomes. By examining job costing data, decision-makers can identify areas where costs may be exceeding projections, enabling them to make informed adjustments that enhance financial performance.

The CFMA explains Job Costing:

Job costing is a critical tool for many contractors and can serve as a report card for completed and uncompleted contracts as well as a guidepost for future work. Effective job costing can identify indicators of financial stress and help organizations shape a plan to overcome these challenges.

In terms of profitability, accurate job costing helps businesses understand which projects are yielding the highest returns. This knowledge allows organizations to allocate resources more effectively and prioritize projects that align with their financial goals. Additionally, by tracking labor, materials, and overhead costs in real-time through job costing reports, companies can pinpoint inefficiencies and implement strategies to reduce waste.

Understanding Job Costs

Understanding the key components of job costing can help organizations manage their finances more effectively.

Direct Costs

The first component is direct costs, which are expenses that can be directly attributed to a specific job. These typically include materials, labor, and any other costs that are incurred specifically for the project at hand. Accurate tracking of direct costs is essential for determining the profitability of each job.

Indirect Costs

Next, we have indirect costs. Unlike direct costs, these expenses cannot be traced back to a single job and are often shared across multiple projects. Indirect costs may include administrative salaries, utilities, and office supplies. Allocating indirect costs appropriately is vital for achieving an accurate overall cost assessment.

Overhead Costs

Lastly, overhead costs encompass both direct and indirect expenses related to running a business but not directly tied to any one project. These might include rent, insurance, and depreciation on equipment. Understanding overhead costs allows businesses to set appropriate pricing strategies that cover all necessary expenditures while ensuring profitability.

By carefully analyzing these components—direct costs, indirect costs, and overhead costs—businesses can gain valuable insights into their financial health and make informed decisions about future projects.

Step by Step Process

Several key steps ensure all costs associated with a specific job are accurately tracked and managed:

Identify Costs

The first step is to identify all potential costs related to the project. This, again, includes direct costs such as materials, labor, and equipment, as well as indirect costs like overhead expenses. A thorough understanding of these costs allows businesses to create a comprehensive budget for each job.

Allocate Costs

Once the costs have been identified, the next step is to allocate them appropriately. This involves assigning specific expenses to individual jobs based on their usage or contribution. For instance, labor hours can be allocated based on time sheets, while material costs can be assigned according to purchase orders. Proper allocation ensures that each job reflects its true cost and helps to determine profitability.

Monitor and Adjust

The final step in the job costing process is continuous monitoring and adjustment of costs throughout the project lifecycle. Regularly reviewing actual expenditures against budgeted amounts allows businesses to identify variances early on. If certain areas exceed expectations or fall short, adjustments can be made promptly—whether it’s reallocating resources or revising project timelines—to keep the project on track financially.

By following these steps—identifying, allocating, monitoring, and adjusting—businesses can effectively manage their job costing processes and enhance overall financial performance.

Types of Job Cost Reports

Job cost reports play a crucial role in managing construction projects effectively. Among the various types of reports, Cost to Complete (CTC) Reports and Work in Progress (WIP) Reports are particularly significant.

Cost to Complete

Cost to Complete (CTC) Reports provide an estimate of the remaining costs needed to finish a project. This report helps project managers assess whether they are on track with their budget and identify any potential financial shortfalls before they become critical issues. By analyzing CTC data, stakeholders can make informed decisions about resource allocation and project timelines.

Work in Progress

On the other hand, Work in Progress (WIP) Reports offer insights into the current status of ongoing projects by detailing completed work against budgeted costs. These reports help track progress over time, allowing construction teams to evaluate performance and adjust plans as necessary. WIP Reports also serve as a valuable tool for financial reporting, providing transparency for stakeholders regarding how funds are being utilized throughout the project’s lifecycle.

Together, CTC and WIP Reports form an essential framework for monitoring financial health in construction projects, enabling better forecasting and strategic planning while ensuring that projects remain within budgetary constraints.

Common Challenges

Job costing is an essential process for businesses to accurately assess the expenses associated with specific projects. However, several common challenges can complicate this process.

Cost Tracking Errors

One significant issue is cost tracking errors, which can arise from inaccurate data entry or miscommunication among team members. These errors can lead to inflated costs and misinformed decision-making.

To prevent these issues, businesses should implement several strategies. First, establishing clear protocols for data entry and regular audits can help identify and correct errors early on. Investing in modern accounting software that automates cost tracking can reduce human error and improve accuracy. Furthermore, providing comprehensive training for employees involved in financial processes ensures they understand the importance of accurate cost tracking and are equipped with the necessary skills to perform their tasks effectively.

Overhead Cost Allocation

Another challenge is the allocation of overhead costs. Properly distributing indirect costs such as utilities, rent, and administrative salaries across various projects can be complex. If these overheads are not allocated correctly, it may result in misleading profit margins and project evaluations.

To fix this, businesses should analyze their operations and determine the most appropriate allocation methods for each type of overhead. Implementing a routine review process ensures that the allocation remains relevant and reflective of actual expenses.

Project Scope Creep

Additionally, project scope changes often pose a challenge in job costing. As client needs evolve or unforeseen circumstances arise, adjustments to the project scope can lead to increased costs that were not initially accounted for. This necessitates continuous monitoring and recalibration of budgets to ensure that all expenses are accurately captured and reported throughout the project’s lifecycle.

By documenting any alterations to the original scope, project managers can communicate effectively with stakeholders about how these changes impact overall objectives. This transparency fosters trust and allows for informed decision-making.

Correct Mistakes with Change Management

By addressing these mistakes—identifying all relevant costs, using multiple allocation bases where necessary, and conducting regular reviews—businesses can achieve more accurate overhead allocations that enhance financial clarity and support better strategic decisions.

Additionally, implementing a structured change management process can help in navigating scope changes smoothly. This involves assessing the impact of proposed changes on project deliverables and timelines before approval. By combining accurate reporting with a robust change management framework, teams can adapt to new requirements while minimizing disruption and ensuring that projects remain on track.

Job Costing Software Enhances Efficiency

Industry-standard software like Procore, Sage 300 Construction and Real Estate, and Viewpoint Vista include job costing tools in their solutions. These platforms offer robust functionalities tailored to track project costs accurately, manage budgets, and streamline reporting processes.

Benefits of Software Integration with Accounting Systems

Integrating job costing software with accounting systems enhances data accuracy and reduces manual entry errors. This seamless connection allows for real-time financial tracking, enabling construction managers to make informed decisions based on up-to-date financial information.

Features to Look for in Job Costing Software

When selecting job costing software, look for features such as customizable reporting capabilities, budget tracking tools, and user-friendly interfaces. Additionally, ensure that the software supports mobile access and offers integration options with other essential business applications to maximize efficiency.

Future Trends in Job Costing

As businesses continue to evolve, the future of job costing is set to undergo significant transformations driven by technology and data analytics. One of the key trends is the integration of real-time data collection tools that allow companies to track costs more accurately and efficiently. This shift towards automation not only streamlines the reporting process but also enhances decision-making capabilities by providing timely insights into project expenditures.

Additionally, the rise of cloud-based solutions is revolutionizing how organizations manage their job cost reports. These platforms facilitate collaboration among team members and stakeholders, enabling them to access financial data from anywhere, at any time. As a result, businesses can expect improved transparency and accountability in their financial reporting practices, ultimately leading to more informed strategic planning and resource allocation in the future.

Anterra Job Cost Forecasting

Predict Your Cost at Completion

Whether you’re using Sage 300 CRE, Viewpoint Vista, Procore Financials, or Acumatica Construction — Anterra CPM has accurate Job Cost Forecasting.

- • Forecast at the Job, Cost Type, or Cost Category level

- • S-Curve reporting to visualize financials

- • Drill-down to the transactional details of the job